Credit and Cents may earn a commission from affiliate partners (at no additional cost to you) on many offers and links. This commission may impact how and where certain products appear on this site (including, for example, the order in which they appear).

Welcome to Credit and Cents, your source for building financial awareness on your journey to financial freedom.

Customers today have many choices for selecting the best checking account. The best checking accounts offer low to no monthly fees, a welcome cash bonus usually with setting up a direct deposit, and the availability of a debit card for ATM access and purchases.

People looking for the best online checking accounts can find accounts that offer a good website and a mobile app that lets you deposit checks remotely.

The best checking accounts below were selected for the institution’s reputation, no monthly fee, commitment to customer service, and the perks offered.

Bank |

Rate (APY) |

Bonus |

Monthly Fee |

Apply |

|

|

|

|

|

|

|

|

|

|||

CIT Bank eChecking |

Up to 0.25% |

– – |

$0 |

Open Now |

Upgrade – Rewards Checking Plus |

– – |

$200 |

$0 |

Open Now |

Quontic Bank High Interest Checking |

1.10% |

– – |

$0 |

Check Website |

Capital One 360 Checking |

0.10% |

– – |

$0 |

Check Website |

Lending Club – Rewards Checking |

0.10% |

– – |

$0 |

Check Website |

Average Interest Rate on Interest Checking Accounts – 0.07% (Source: FDIC – 4/21/25)

Streamline Payments, Save Big: The Melio Advantage for Businesses. Amplify Cash Flow with Melio!

Learn More about Using Melio Pay for Free

Click here to learn more about how online checking accounts are different from traditional checking accounts

CIT – eChecking

-

No monthly fees

-

No overdraft fees

-

CIT Bank does not charge ATM fees. Get up to $30 in other bank’s ATM fees reimbursed per month

-

Make unlimited withdrawals and deposit checks with CIT Bank mobile app

-

Debit card with EMV chip technology

-

Open with a minimum of $100

Upgrade – Rewards Checking Plus

-

Get a $200 welcome bonus when you open an Upgrade credit card and a Rewards Checking Plus account and make 3 qualifying debit card transactions from your Rewards Checking Plus account within 60 days of the date the Rewards Checking Plus account is opened*

-

No monthly fee

-

Set up a monthly direct deposit of at least $1,000, and your account is eligible for benefits such as 2% cash back on purchases at drug stores, restaurants, gas stations and other everyday places, up to a maximum of $500 in rewards per calendar year**

-

ATM fee rebates for qualifying accounts

-

Rewards Checking Plus account holders can get a rate discount of up to 20% on Upgrade loans and credit cards

*To qualify for the welcome bonus, you must open and fund a new Rewards Checking Plus account through Upgrade and make 3 qualifying debit card transactions from your Rewards Checking Plus account within 60 days of the date the Rewards Checking Plus account is opened. If you have previously opened a checking account through Upgrade or do not open a Rewards Checking Plus account as part of this application process, you are not eligible for this welcome bonus offer. Your Upgrade Card and Rewards Checking Plus account must be open and in good standing to receive a bonus. To qualify, debit card transactions must have settled and exclude ATM transactions. Please refer to the applicable Upgrade Visa® Debit Card Agreement and Disclosures for more information. Welcome bonus offers cannot be combined, substituted, or applied retroactively. The bonus will be applied to your Rewards Checking Plus account as a one-time payout credit within 60 days after meeting the conditions. This one-time bonus is available through this Upgrade Card offer and may not be available for other Upgrade Card offers.

** Without direct deposit, you’ll earn 1% cash back. Once you earn $500 in rewards with the 2% cash back, you’ll earn 1% on all other purchases or payments for the rest of the year.

See if you qualify in minutes without hurting your credit score

Apply

Upgrade Triple Cash Credit Card Highlights:

-

No annual fee

-

Unlimited cash back on payments – 3% on Home, Auto and Health categories and 1% on everything else after you make payments on your purchase

-

Combine the flexibility of a credit card with the predictability of a personal loan

State Exclusions: Not available in DC, IA, WV, WI. The card is issued by Sutton Bank.

Frequently asked questions

How to choose the checking account that is right for me?

Among the important criteria in shopping for a checking account are account minimums, monthly service fees and ATM charges. However, many checking accounts offer the option of waiving the monthly service fees either with a monthly direct deposit or by keeping a certain minimum balance in the account. We recommend staying away from checking accounts that do not allow you to waive monthly service fees. Our featured checking accounts show that there are Banks insured by FDIC or NCUA that offer checking accounts that do not charge fees and have minimal balance requirements (if any).

Other factors in evaluating checking accounts include cash bonuses offered for opening a new account (including the requirements to qualify for the cash bonuses), any interest earned on balances, a good website along with a mobile app that lets you deposit checks remotely, and perks like free checks, and cash back rewards.

Can checking accounts help me with my saving goals?

Checking accounts should be thought of as a transactional account, primarily used to pay bills, utilize third-party payment services such as Zelle and for making everyday purchases through the use of debit cards. Although checking accounts offer flexibility with regard to number of withdrawals, when it comes to paying interest, most checking accounts do not pay interest and those that do usually offer a yield that is quite small (compared to a high yield savings account, which usually allows for up to 6 withdrawals per month). Some online checking accounts may offer better interest and can be bundled with a high yield savings account to maximize your earn from available balances.

To save for emergencies, or to grow your balances fast the high yield online savings accounts are the better option as those accounts usually offer a much higher yield.

How many checking accounts can I have?

While there’s no limit to the number of checking accounts you can have, and provided you are able to meet the requirements of those accounts to avoid fees, the number of checking accounts you should have is mostly based on your personal needs. For example, if you’re married, you may want to have a personal account and a joint account that you share with your spouse, or if you are a small business owner, you should have a separate checking account for your business to help track your business activity separately from your everyday household expenses.

Why trust Credit and Cents?

Credit and Cents provides market research and market-leading products to empower our readers to make informed decisions about their money. Experts with extensive industry knowledge of credit and deposit products compile our comparison charts and product reviews. Although Credit and Cents earns a commission from affiliate partners, our product reviews are based on our research without influence from outside third parties.

Credit and Cents is an affiliate partner for CIT Bank (a division of First Citizens Bank), and Valley Direct Bank (a digital only subsidiary of Valley Bank).

We provide competitive research and product information so that you can apply for the high-yield account that makes the best sense for you. All accounts are opened on the Bank sites only (no customer information is collected on the Credit and Cents site).

Still have questions about whether a High-Yield Checking account is right for you? Email us at ccmarketing@creditandcents.com.

About Valley Bank

Founded in 1927, Valley Bank is a regional bank with $64 billion in assets. It is among the most reputable financial institutions in the industry and one of the largest banks in the US.

Valley Bank has more than 200 branch and commercial banking locations across Alabama, Florida, New Jersey, New York and California.

Valley Direct Bank, a subsidiary of Valley Bank, offers a High Yield Savings Account with one of the nation’s highest rates.

Is Valley Direct legit?

Yes, Valley Direct is a trustworthy provider of savings products. It operates as the online division of Valley Bank, a well-established financial institution that is a member of the Federal Deposit Insurance Corporation (FDIC). This means that accounts opened with Valley Direct are insured by the FDIC for up to $250,000, ensuring your deposits are protected. Valley Bank, which has been in operation since 1927, manages over $61 billion in assets (as of October 2024), demonstrating its stability and long-standing presence in the banking industry.

About CIT Bank

CIT Bank, a division of First Citizens Bank, stands as a trustworthy institution with a rich legacy of strength and stability. It’s the largest family-controlled bank in the US, boasting over $100 billion in assets. Recognized for exceptional customer experience and a high rating by Nerdwallet.com and Bankrate.com, CIT Bank is committed to your financial well-being.

CIT Bank was ranked #1 by the American Banker magazine for customer experience.

Overall, CIT Bank receives 4.0/5 (by Nerdwallet.com), and a high 4.3/5 (by Bankrate.com).

“If you’re looking for bank accounts with higher earning potential, CIT Bank may be a great option. The combination of competitive rates and low minimum opening deposits makes CIT an attractive option for online banking.

Its money market account earned CIT a spot on Forbes Advisor’s The Best Money Market Accounts 2021.” – Forbes Advisor (January 26, 2021)

CIT Bank’s awards include:

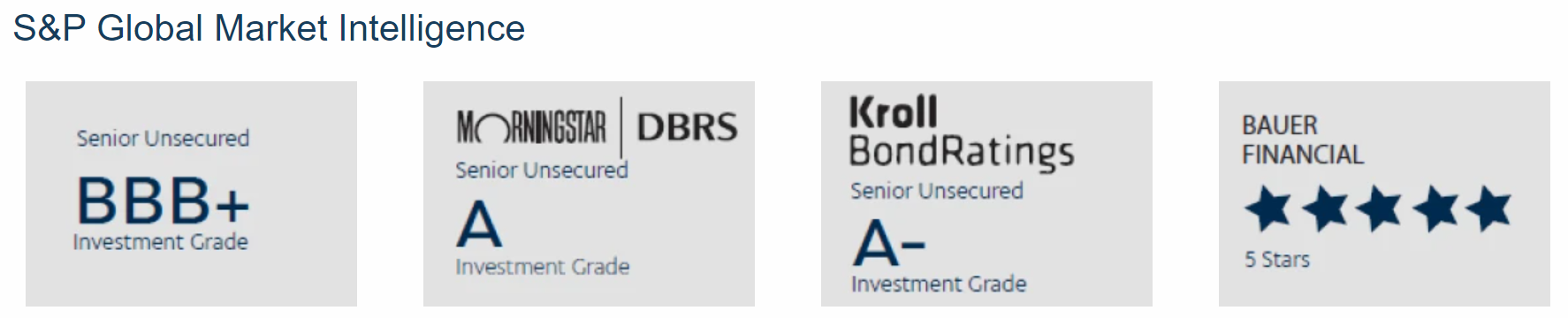

About Upgrade Inc.

Upgrade, Inc. is an American fintech, headquartered in San Francisco, founded in 2016 by former CEO and colleagues of Lending Club. Since 2017, Upgrade has made over $3 billion in loans. The company offers credit and banking products to consumers and delivers fixed-rate credit cards and loans. FDIC Insured.

The Better Business Bureau

(BBB) gives Upgrade an A+ rating.